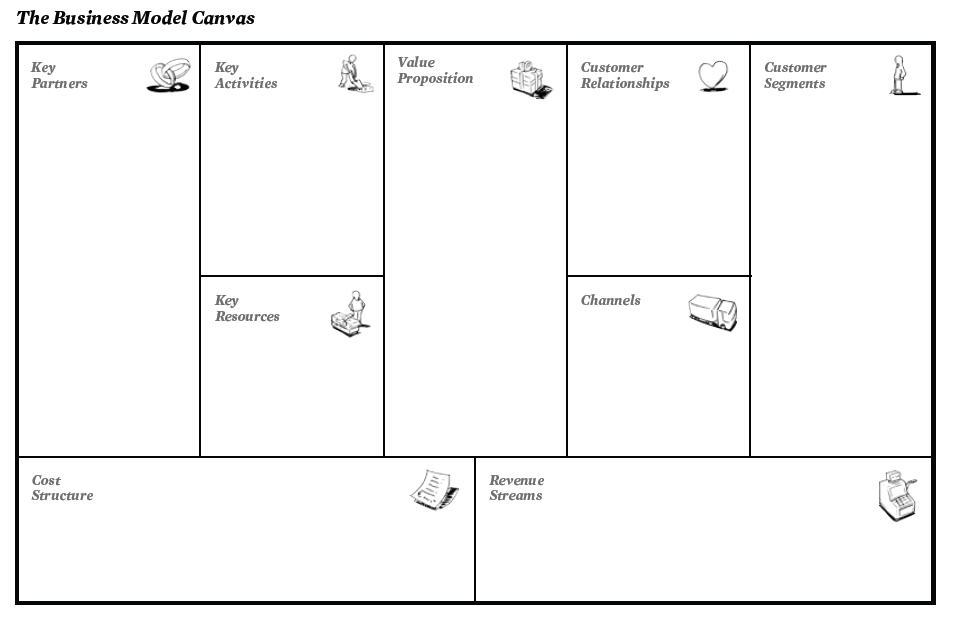

What does it take to run a Business? A true entrepreneur sees challenges as possibilities and opportunities on the way, and creating a business is a natural step. Defining and analyzing the building blocks of your business offers variables and context for sharpening the saw. This descriptive model comes from the best Business Model Meta-Boek I came across in years: “Business Model Generation” it offers a field-tested frame-work with building blocks to analyze current ventures and create sustainable new ones.

[Abstract from the book Business Model Generation]1. Customer Segments (CS) An organisation serves one or several Customer Segments.

[Mass market, Niche Market, Segmented, Diversified, Multi-sided platforms (or multi-sided markets)]

2. Value Propositions (VP) It seeks to solve customer problems and satisfy customer needs with Value Propositions.

[Values may be quantitative: (price, speed of service) or qualitative (design, customer experience). The elements: Newness, Performance, Customization, “Getting the job done”, Design, Brand/status, Price, Cost Reduction, Risk Reduction, Accessibility, Convenience/usability]

3. Channels (CH) Value Propositions are delivered to customers through communication, distribution, and sales Channels.

[Channel Types: Own (direct) sales force, web sales, own stores; Partner (indirect) partner stores, wholesaler. Channel Phases: 1. Awareness How do we raise awareness about our company’s products and services? 2. Evaluation How do we help customers evaluate our organization’s Value Proposition? 3. Purchase How do we allow customers to purchase specific products and services? 4. Delivery How do we deliver a Value Proposition to customers? 5. After sales How do we provide post-purchase customer support?

4. Customer Relationships (CR) Customer Relationships are established and maintained with each Customer Segment.

[Personal assistance (human interaction: on-site, call centers, e-mail, …), Dedicated Personal Assistance (account manager), Self-service, Automated services, Communities, Co-creation.]

5. Revenue Streams (RS) Revenue Streams result from Value Propositions successfully offered to customers.

[Asset sale, Usage fee, Subscription fees, Lending/Renting/Leasing, Licensing, Brokerage fees, Advertising]

6. Key Resources (KR) Key Resources are the assets required to offer and deliver the previously described elements …

[Physical, Intellectual, Human, Financial]

7. Key Activities (KA) … by performing a number of Key Activities.

[Production (activities relate to designing, making, and delivering a product in substantial quantities and/or of superior quality), Problem solving (activities of this type relate to coming up with new solutions to individual customer problems), Platform/network (a platform as a key resource is dominated by platform or network related Key Activities: Networks, matchmaking platforms, software and brands can function as a platform]

8. Key Partnerships (KP) Some activities are outsourced and some resources are acquired outside the enterprise.

[Four Types of partnerships: 1. Strategic alliances between non-competitors, 2. Coopetition: strategic partnerships between competitors. 3. Joint ventures to develop new businesses. 4. Buyer-supplier relationships to assure reliable supplies. Motivation for creating partnerships: Optimization and economy of scale, Reduction of risk and uncertainty, Acquisition of particular resources and activities.]

9. Cost Structure (CS) The Business Model elements result in the Cost Structure.

[What are the most important costs inherent in our business model? Which Key Resources are most expensive? Which Key Activities are most expensive? Cost-driven (minimize costs wherever possible), Value-driven (focus on value creation), Characteristics of Cost Structures: Fixed costs (costs that remain the same despite the volume of goods or services produced), Variable costs (costs that vary proportionally with the volume of goods or services produced), Economies of scale (cost advantages that a business enjoys as its output expands), Economies of scope (cost advantages that a business enjoys due to a larger scope of operations).